The amazing economy that these MAGA people dream of getting back to can be largely attributed to two things. The first is lots of manufacturing, which the CHIPS Act is a step in the right direction towards, but is impossible to ever really get back to ever since Nixon opened the door to China as a trade and manufacturing superpower in the 70s, and companies decided to lower costs by sending manufacturing over there. The second is a MUCH higher business tax rate. At one point, it was 91%. I’m not saying that that’s the correct rate in the modern economy, but 28% ain’t shit. Raise it to 40% at least, and then use that additional revenue to get everyday Americans’ heads above water.

I’m an extremely lucky 35-year-old American white guy, married with no kids or pets, denied ourselves several comforts and luxuries, and I’m still just now at a point where I’m trying to buy my first home. I have almost every advantage possible, and I’m still over ten years behind my parents’ generation. That shit ain’t right. Help us, the people.

The higher the corporate tax rates the more the companies reinvest into the company to keep profit margins down which causes the economy to flourish rather than funneling as much cash as possible to shareholders.

Companies generally would rather pay their own workers more than pay more in taxes. If you’re going to lose the money anyway, might as well spend it keeping your workforce happy than give it to the government.

You might be right, but what’s silly is that you think companies wouldn’t do everything in their power to not reduce pay to both workers and the government at the same time. And they do. In fact, they lobby endlessly to lower their taxes as well as keep wages low, loosen regulations, dismantle the power of unions, roll back labor rights, and take away voting power of the people who would vote against their interests. You need to understand that the entire motivation of these companies is to maximize profit at all costs. “If you’re going to lose the money anyway” is not something they have ever or will ever accept. That’s like assuming that you accept that you will never eat another scrap of food ever again. Your survival depends upon it, and when access to it is threatened, you will lie and cheat and steal as much as is necessary to ensure your survival.

If the government taxed businesses at a higher rate and used that increased revenue to improve the quality of life and access to opportunities for all, I’d say that that’s a much better use of that money. We’ve tried taxing businesses less in hopes of having anything other than piss trickle down to the workers. That’s how we got here. Productivity has boomed, yet wages have stagnated and people are struggling to get by. It’s time to stop propagating broken bullshit-ass Reaganomics and start advocating for your fellow human to be able to afford access to the bare minimum of food, shelter, and medical care. The GDP of the US is over $25 TRILLION. So why in the blue fuck are people still freezing and starving to death in this country? Unacceptable.

Yes it would be ideal for the government to do all that, I’m just saying that increased corporate tax rates lead to increased reinvesting into the companies themselves which is generally good for workers. Part of them avoiding paying taxes would lead to working at those companies being better because pushing pure profit margins wouldn’t be as effective for gathering wealth. There are so many companies where it is downright miserable working for them due to rampant cost cutting to make record breaking profits, so tax the fuck out of those profits and stupid choices like that become less fiscally appealing.

For instance In order to boost profit margins at the end of last year 7 Eleven put a halt to all preventative maintenance. If it is no longer cost effective to do that due to high taxes on those profits that maintenance would have been done which would have seen a higher retention in maintenance staff. (As well as less money spent replacing equipment in 2024)

I’m not saying one change will fix everything, but it’s a start.

Congrats, I just bought a cottage because rents have gone insane

Rents have gone so insane that (assuming everything goes smoothly and we close) we will spend like $500 less per month by moving from our 2 bedroom apartment into a 4 bedroom 1800sqft townhouse. It’d be even less if interest rates weren’t dog water right now haha. But there was only one other family competing to go under contract, so the high interest rate is how we got ahead of the upcoming gold rush. Houses are about to go for much higher than right now.

God I can’t wait until US news headlines aren’t tainted with the name Trump. I’m so tired of it all.

There is one headline with his name that I can’t fucking wait to see.

Yeah me too but then the guy missed.

…Oh wait, you mean the other headline.

Personally, I was going for the McHeartattack option.

I’m hoping it’s a Stroke, man!

I just can’t wait to never hear of this dude ever again, or see his name or his anus mouth. It’s been a fucking agonizing 8 years with this mother fucker.

deleted by creator

I know, I’ve just waiting for this turd to flush since 2016

We all have. Damn shame he turned out to be a floater, but let’s hope this time does it.

Time defeats all men. His clock is ticking.

While true, it would be a more reassuring fact if hadn’t ample time still to make a huge dent in both America and the world at large before he goes.

He shouldn’t even be allowed to run, how can you foment a coup and still run for President. Failed state

There’ll always be someone else. But we may have a bit of silence when Trump is gone.

Same here. I was exhausted with his run in 2015/2016 and being the king of the birthers and hoped his loss would put his stupid name behind us and he could go back to trying to make a name for himself with morning zoo DJs or wrestling or whatever the fuck.

I despised the guy even before he was given that stupid game show. It got even worse when he “won” in 2016.

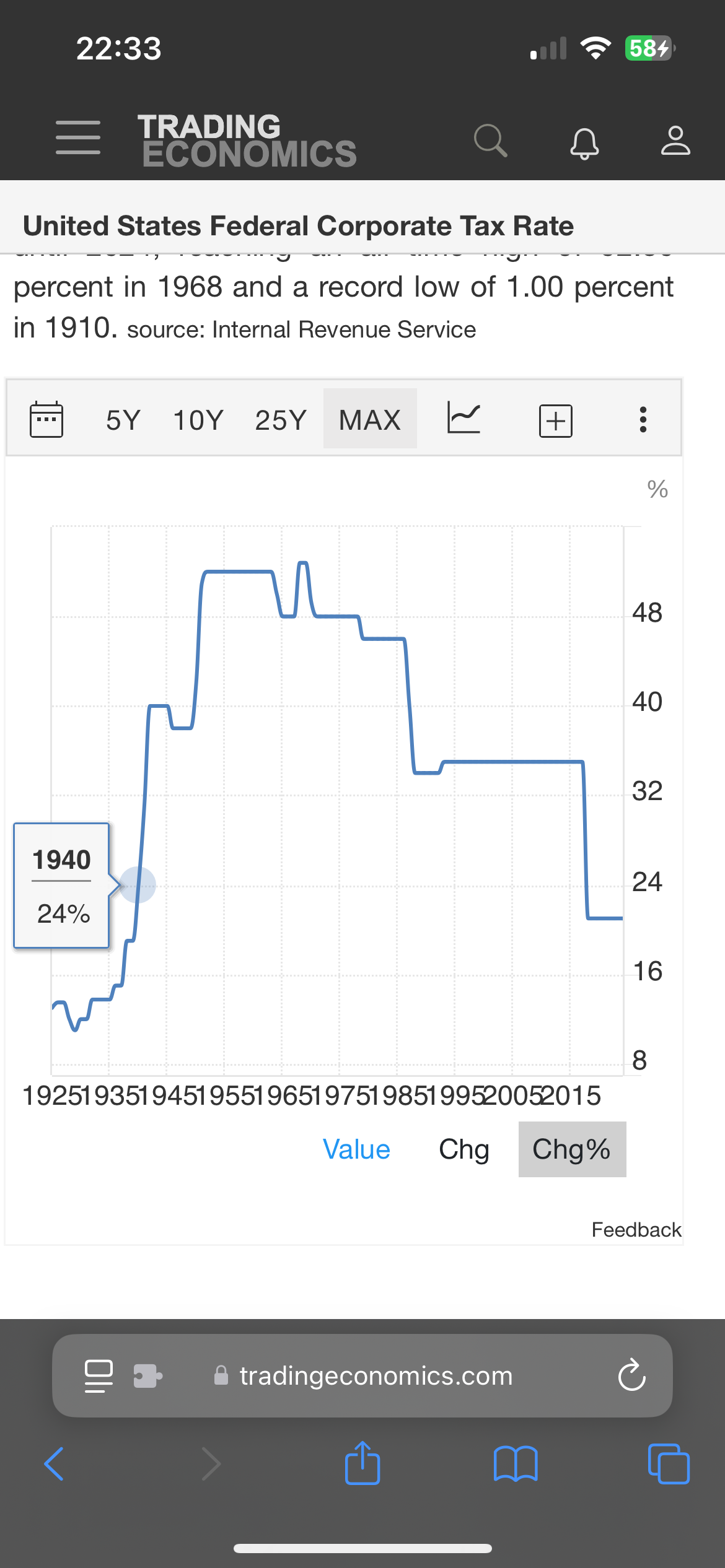

Republicans love to harken back to “the golden age” of america. Ever wonder what paid for it? A big portion was … corporate tax!

https://taxfoundation.org/data/all/federal/historical-corporate-tax-rates-brackets/

Corporate tax is currently at the lowest point since 1940

https://tradingeconomics.com/united-states/corporate-tax-rate

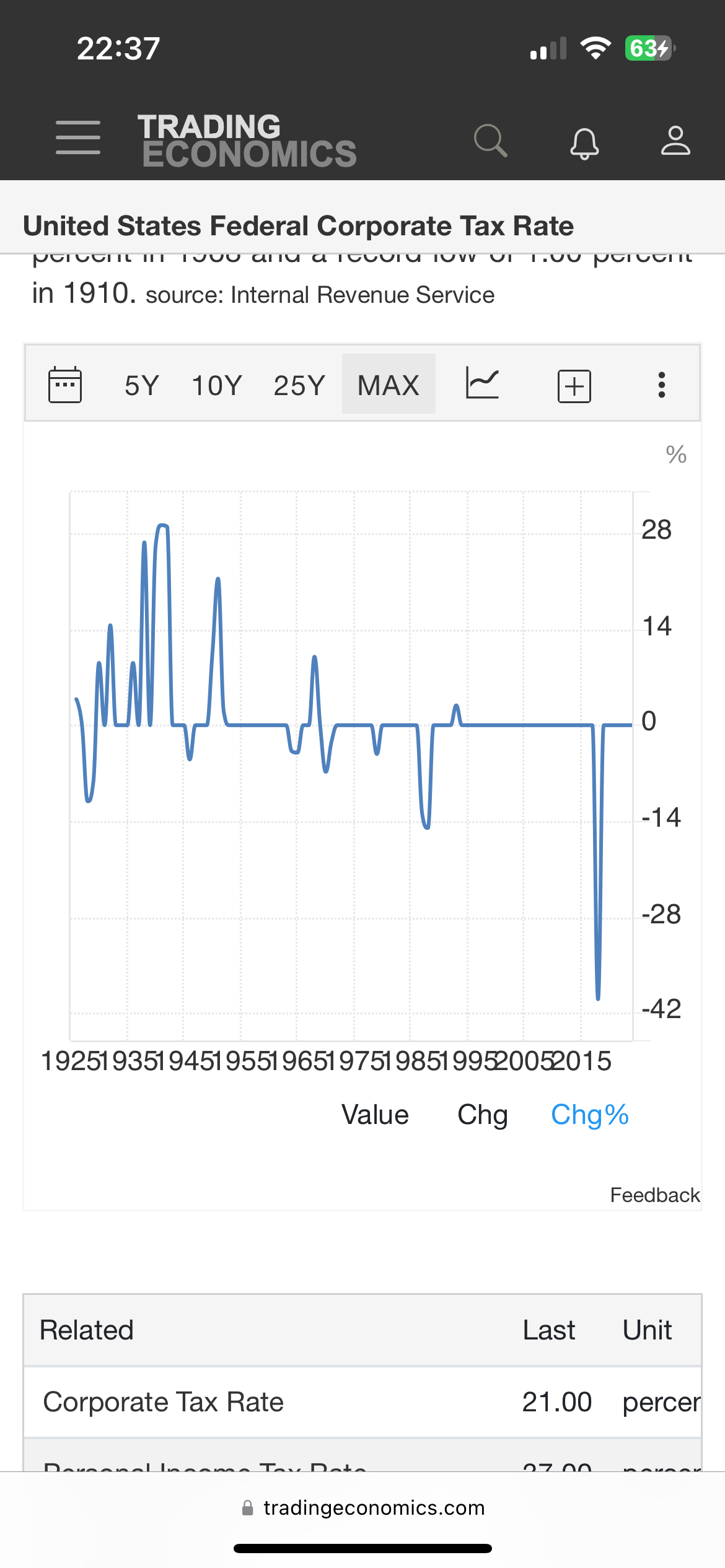

See this big drop in corporate tax? You thank ol’ trumpy for that

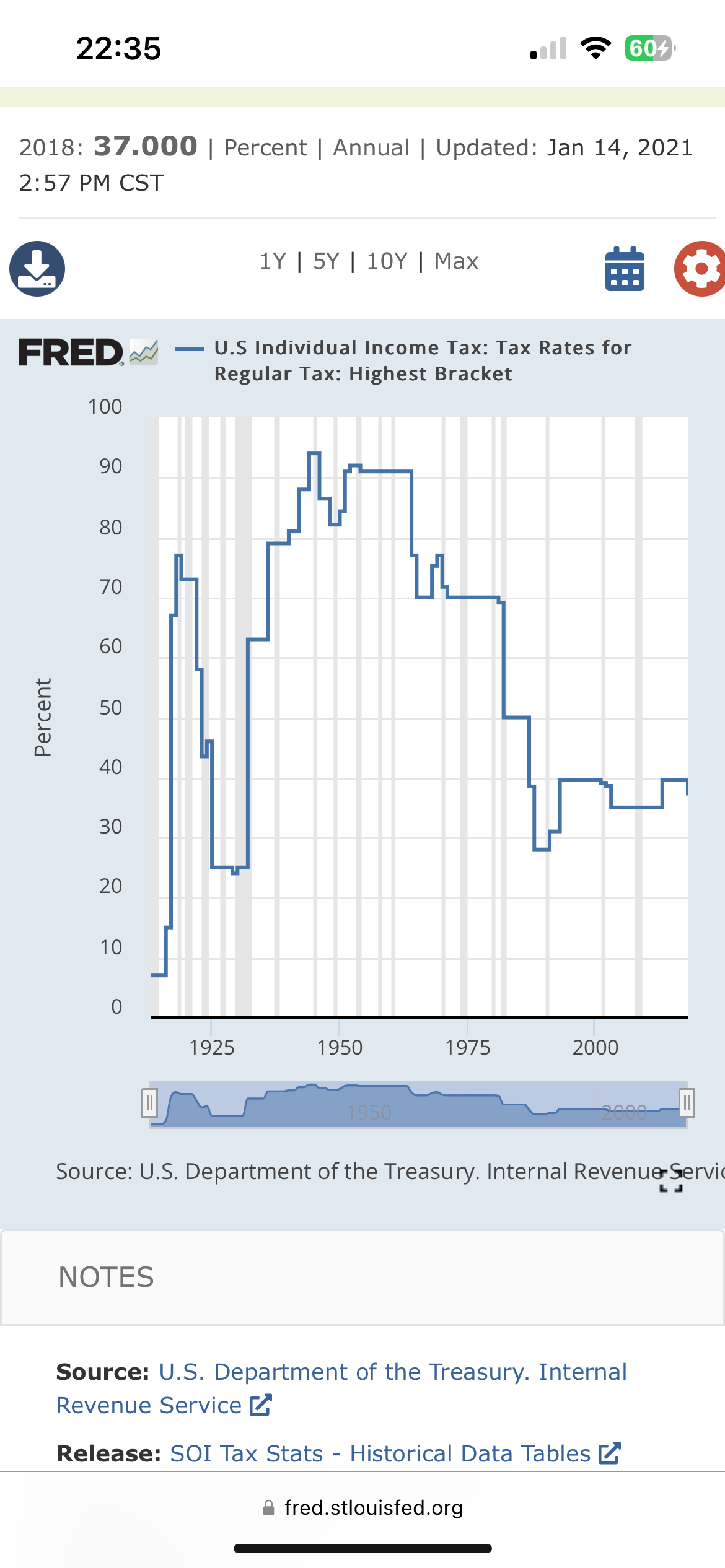

Along with personal income tax - Note this is the top bracket of tax

https://fred.stlouisfed.org/series/IITTRHB

Want your golden age back? Tax these fucking billionaire grifters.

Reminded of wtfhappenedin1971.com

The numbers, what do they mean?

Another thing that raising the corporate tax rate does is make it more profitable to re-invest your income into the company. Since they’re only taxed on profits they’ll pay zero taxes if they make zero profit. How do you do that? Expanding your business, spending money on R&D, and paying your employees more.

Ideally, yes - but until share buybacks are outlawed - companies will just ‘reinvest’ by buying up shares (increasing their price, and thereby existing shareholder wealth), and issuing them as bonuses to their C-suite in lieu of payment… by-and-large avoiding a lot of the income tax that they would otherwise be due to be paid.

Our current late-stage capitalist corporate system is built upon layers and layers of tax-avoidance and self-enrichment at the cost of society as a whole.

One of the driving economic forces associated with taxation is human nature. You simply cannot legislate around it. Enter the Laffer Curve. Google it. Basically, if the government taxes at zero percent, it gets no revenue. That’s obvious. If the tax rate is 100%, you get the same result. People either won’t work or (more likely) they’ll work for cash under the table. Tax evasion becomes a full-time indoor sport. As government increases tax rates from 0% to 10%, it gets money! It gets even more if it goes from 10% to 20%. But soon that revenue curve that was steadily increasing starts to bend downward toward 0% again as tax rates increase. Liberals think that if you get $X with a tax rate of 33%, then you’ll get three times as much if tax rates triple to 100%. Nope! This isn’t just a theory. It’s a recorded historical event. We’ve seen certain tax rates be reduced and yet revenue increased! Magic? Nope. The tax rate was simply on the right side of the Laffer Curve. Makes sense! This principle also demonstrates that there is a maximum amount of revenue any government can extract from the population. Politicians promising more spending than this maximum revenue level are pandering, or perhaps are economicly uneducated. Perhaps they lack a understanding of human nature. They do understand that many voters are also economically uninformed and will vote for politicians who promise free stuff and a “tax the rich” solution to supposedly pay for it all. See you in the Bahamas!

this isn’t science, it is story telling

…? Your numbers literally state that PERSONAL marginal income taxes were 90%. Corporate taxes were, yes, 100% higher. So were personal tax rates.

I stated both. I listed both corporate and personal tax. What are you referring to?

edit - do you mean the personal bracket?

Are you argiuing that corpate tax rates should double to its peak rates? Would that also mean personal rates should double back to its peak? Graphs paint a very incomplete and poor picture that are easily misunderstood.

In the 1950’s, the top marginal tax rate was 90%, but people were allowed to avoid income tax by funneling income through corporate tax shelters, leaving a top effective tax rate that wasn’t much higher than it is today. Not only that, but the tax burden has also shifted dramatically since the 1950’s. In Eisenhower’s day, those earning more than $100,000 per year shouldered around 20% of the tax burden. Today, the equivalent economic class shoulders over 80% of the tax burden. Lowering the tax rates and eliminating loopholes in the 1960’s and 1980’s actually resulted in the rich paying a much higher share of total taxes.

The high rate created incentives for corporations to find ways to minimize their tax burden, such as increasing debt financing, retaining earnings, and pursuing tax loopholes. This led to distortions in corporate decision-making and the allocation of capital. Additionally, the high rate may have discouraged some new business formation and investment.

Whether a 90% corporate tax rate, BTW, which never existed, would work effectively today is debatable. The economy and global business environment have changed considerably since Eisenhower’s era. A rate that high could potentially lead to more severe distortions, capital flight, and reduced competitiveness for U.S. companies in the modern globalized economy. Most tax policy experts believe a more moderate corporate rate, combined with a broader tax base and fewer loopholes, would be more effective at raising revenue while minimizing economic distortions.

The data shows that, between 1950 and 1959, the top 1 percent of taxpayers paid an average of 42.0 percent of their income in federal, state, and local taxes. Since then, the average effective tax rate of the top 1 percent has declined slightly overall. In 2014, the top 1 percent of taxpayers paid an average tax rate of 36.4 percent.

All things considered, this is not a very large change. To put it another way, the average effective tax rate on the 1 percent highest-income households is about 5.6 percentage points lower today than it was in the 1950s. That’s a noticeable change, but not a radical shift.

Awwww… Raise it above the old 35% tax rate at least.

It’s still a start, and something more likely to get though congress

And index it against inflation. 😉

No better: to the cost of living index. That way if they pump prices up like they have in the last few years, they choke themselves with their own rope.

49% is golden. But 28% is a start.

Staggered based upon gross income just like personal taxes.

Tiny businesses 5% Small businesses 25% Mid sized companies 50%. Mega-corporations wth billions - 95%

One problem with that is that companies could create a ton of subsidiaries or shell companies and move money around in funny ways to keep all of them at the lowest bracket

Sure. Gimme a progressive tax rate across the board.

NBC News - News Source Context (Click to view Full Report)

Information for NBC News:

MBFC: Left-Center - Credibility: High - Factual Reporting: High - United States of America

Wikipedia about this sourceSearch topics on Ground.News

you suck

Does it really matter what the rate is when they don’t pay it anyway?

"The analysis names 35 corporations, including Tesla, Netflix and Ford, that each reportedly spent more on compensation to their five highest-paid executives than they paid in federal income taxes over five years.

Collectively, the 35 corporations spent $9.5 billion on their top executives over that span, the report said, while their combined federal tax bill came to -$1.8 billion: a collective refund."

What’s your conclusion? That we shouldn’t tax anyone at all?

Why isn’t your conclusion that we should find these husks of supposed humans and turn them inside out? Why isn’t your conclusion that chunks of SpaceX, chunks of Amazon, chunks of Google, should be rightfully owned by the American public?

Because socialism generally speaking works really really badly? Taxation should ideally be zero, but since there are obvious things 99% of us agree that should be funded in a centralized way, we have to have taxes.

The point of taxes is not to make everyone equal, the point is to fund those important things. For instance: police, military, education, basic healthcare (perhaps), charity for the less fortunate and certain natural monopolies like utilities.

Close the loopholes that let companies with billions in revenue pay 0 in taxes.

Exactly. If the don’t close the loopholes then this means precisely dick.

Imagine if the law was no more can be spent in corporate executive compensation than the company pays in taxes. Idk if that’s a good idea for small cooperations, but it’s a jumping off point.

It makes sense. More income, more bonus. It would also prevent companies from handing out bonuses while operating at a loss.

We could set it so that companies whose CEO’s net worth is less than a half mil are exempt

Here’s a wild idea… tax corporations based on income, not profit.

As much as I like the idea it aint exactly a clean cut rule, a lot of companies operate on slim marjins due to loans or just that being how it is so taxing income could fuck over way more than just the greedy assholes. I do think taxing based off of stock prices should be a thing, the stocks reflect the physical value right? That means they should be able to pay the taxes.

I mean, when I pay my taxes, it’s based on how much money I earned, not how much money I have left over at the end of the year.

If the argument is “Corporations are people, my friend” they should be paying an income tax, same as anyone else.

Holy shit if a corporation is a person…

…does this mean a person is a corporation?

Man it’s so fucking straightforward for the IRS to see that Mom’s fettuccine restaurant is a little bit different from fucking Amazon, Meta, Ford etc from just putting all of it’s money into itself and calling it a loss.

Oh certainly but heres the thing we live in a legalistic society and the sons of bitches would figure out some way of fucking up that type of tax.

Well you brought up like the most manipulatable resource as a means of taxation, so I see why you feel they’d always win. I mean Trump’s entire career has been made simply lying about the value of his assets when it suited him. That’s not a “loophole”, inasmuch as it’s fraud that isn’t caught.

You want it to end? Give the IRS more money. Allow the FEC to attack monopolies and monopsonies. The rich simply lie and print advertisements convincing rubes to destroy the system. Regulate the news, advertising. “Ohh but mah freeze peach”, well then you get unregulated, untaxable, unrestrained capitalistic greed.

I gotta tell ya, “is planning on increasing corporate taxes” seems like the right direction to me. So, yes.

Yes, there’s more to be done, obviously.

For someone who clearly knows how fucked the issue is that wording seems almost distracting from the road that will get us to a solution. It’s a good thing, let it happen.

Sounds great to me.

I’m game for over 50% really

The GOP wants to take America back to when it was “great,” as long as “great” ignores when the rich and companies paid their fair share for infrastructure, schools, etc.

God forbid we actually decided to pay for those things again and stopped letting the country rot.

Shocker, things go to shit when you don’t pay for them and or sell them off to private companies. Looking at you, Starliner capsule.

If corporations were being honest, they’d acknowledge that’s a bargain.

If corporations were being honest

When has that happened?

I’m with you, though. I’ll dream…

Talk about taxing private citizens who have more money than some nations.

Pre-80s tax rate for the wealthy was 70%.

That needs to be restored.

Good step and i hope it leads to a great finish. i.e. >50%

51% on bonuses here in Sweden

Do it now. Make it retroactive.

Rookie numbers. Gotta bump those up.