US consumers remain unimpressed with this progress, however, because they remember what they were paying for things pre-pandemic. Used car prices are 34% higher, food prices are 26% higher and rent prices are 22% higher than in January 2020, according to our calculations using PCE data.

While these are some of the more extreme examples of recent price increases, the average basket of goods and services that most Americans buy in any given month is 17% more expensive than four years ago.

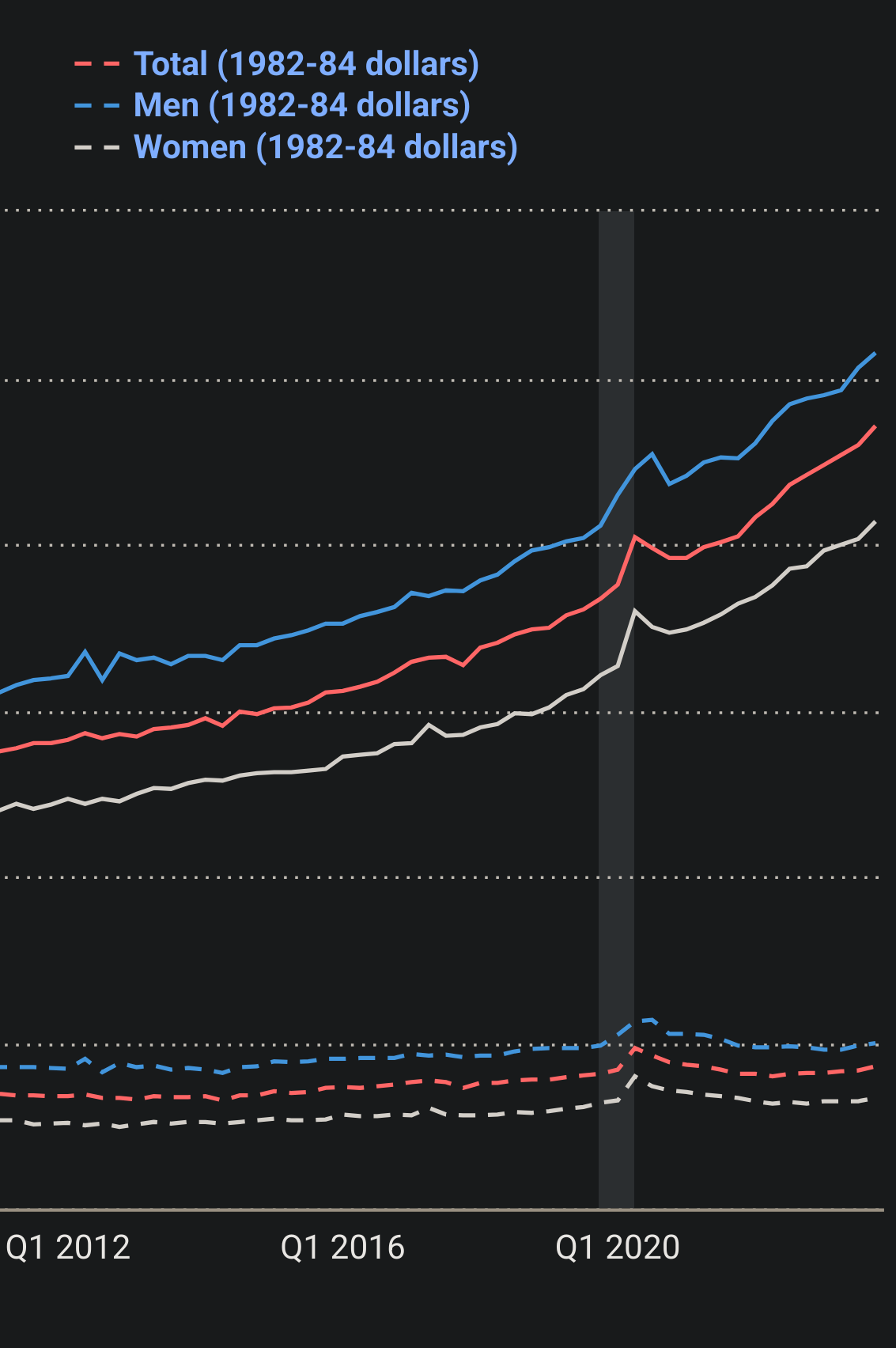

If you want to know why Americans are bummed out about their purchasing power, just look at this chart about how wages abruptly stopped increasing with productivity 45 years ago. People are accomplishing more than ever before in history and being left with less buying power. In many cases wages don’t even keep pace with inflation because companies pay based on what they can get away with, not what the work is worth.

the average basket of goods and services that most Americans buy in any given month is 17% more expensive than four years ago.

That’s 4% per year

And now much has pay gone up?

They claim it’s gone up more than that, but I’m very curious where they’re getting these numbers.

Here’s US bureau of labor statistics:

Pay went up faster than inflation compared to before the pandemic

That graph shows real wages as being flat for the last 24 years, and even the bump you mentioned was barely noticable and fell back to baseline in like a year.

What would the chart look like when we exclude billionaires, C-suite executives, and everyone else who gets paid to own stuff instead of working for a living?

It looks flat, but real wages are up 10% in the last 24 years, highest ever

If we exclude billionaires it will decrease like $0.01 because it’s the median

Is it because of the economy? That’s my first guess.

No, because we have some of the best economy ever

We’ve had higher median real incomes than Q4 2019 since Q3 2022

The whole 2020 decade so far has higher incomes than any point in US history

Alternate headline: “Why Humans Dislike Being Poor”

Americans are right now at some of the best economic times, so that’s surprising

There is a disconnect between the statistics and reality. I am not sure where, but I suspect inflation is not being calculated correctly. It may be that lower cost items rose at a higher rate, so even though it averages out, it’s harder to reduce spending. 17% doesn’t seem to match the numbers I’ve seen for take out and home prices for example.

At the end of the day, it doesn’t matter what’s on a chart it matters how many things people had to choose to not buy or do because they couldn’t afford it.

Didn’t they just adjust the whole inflation index again to not count a bunch of significant things? It’s a joke.

Same with unemployment. It only counts “able individuals who are actively searching for a job”. A lot of people aren’t included in those numbers when they should be.

Rent/housing is like a third of CPI, it’s already being taken into account. Remember, CPI already talked into account these numbers, including higher food costs. But it also takes into account that energy costs did not increase as quickly. Even if some things went up 30%, if other things go up 10% the average can’t possibly be 30%

Also consumer spending is very strong in America right now, so even if some people can’t afford things, other people are way outspending them

The CPI only takes rental prices into account, not home purchases or rental values. Additionally, it only captures active rentals, not asking prices, meaning that it has significant lag and is a poor indicator for trends in rental prices.

This is true, but the average person is paying a mortgage or rent, not moving every single month so the current rental price is the most relevant to people’s expenses