So I’m just one dude and 10k a year just on food seems incredibly high. I don’t go out that often, ~$1600 was at restaurants. I’m not really sure what I’m doing wrong while shopping at grocery stores and want to track grocery purchases better. The store I typically go to doesn’t have online receipts to use.

I’m wondering what kind of apps are available for tracking grocery expenditures that Lemmings would recommend? It would be nice to be able to go back and check prices/sizes of things too, so what is being shrinkflated/skimpflated

Nothing fancy, I mainly use credit card(s) for grocery spending so with each monthly statement will record that’ month’s grocery spend totals in a spreadsheet for spending/budget tracking.

For price comparison I just take a picture of the price tag for something I’m curious about & bring it up on my phone when shopping at a different grocery store. Not the most advanced price tracking but it sort of works :P

Get one credit card you only use at the grocery. If you get one with cash back or points you will get money back.

I recently tried to find the same thing and came up empty. What worked best (though with noticeable shortcomings) was simply making a spreadsheet and comparing prices I found online for the stores I could think of. What I found is that it takes a lot of time, some places don’t have their prices or even all their items on their websites, and that sometimes you end up spending a little (or a lot) more now in order to save money in the long run.

BUT. I also found that some things are consistently cheaper at certain places, and that if you bother to track individual items over time you can start to paint a pretty clear picture of what stores will have the cheapest items. Like, when it comes to chicken breasts and ground turkey, I’m going to Aldi almost every time. But for canned goods, my local H‑E‑B tends to fare a bit better, and is a good second choice for ground turkey.

There is KitchenOwl and Grocy off of Fdroid if you want.

I would focus on it the from a different angle. Instead of tracking grocery spending, I would set a number that you aim to not go over for a given month. Based upon the numbers you provided you spend an average of $700 per month on groceries. If you, for example, aimed to start with reducing your by 50% to $350 per month you would save $4400 yearly. That’s a sizable sum of money that you could put towards a vacation or a buttload of smaller purchases.

As far as how you could go about saving that much, I would advise setting a limit on both how many grocery trips you make and how much you allow yourself to spend on each trip. So lets say you decide on about 4 trips a month (roughly weekly). In that case, spending $80 per trip would safely stay within the budget of $350. There would even be ~$30 leftover for a couple of mini trips for one or a couple items.

To help stay in the budget, it might be helpful to take a small notepad along and log how much each item costs at as soon as you put it in your cart. You can stretch your dollar further by buying the products that tend to be more out of sight and less convenient. The products that are highly visible like the endcaps of aisles and that are at eye level tend to be the more expensive options since they are usually rented by the brands to get the prime attention real estate. Stores with a less than traditional layout, like Aldi, are also a great way to save since they are usually cheaper and let you get more bang for your buck.

Another useful practice might be a simple grocery list. After you write it out but before you go in the store, you could order the items based on how important they are to have. Something like sweets < Potato chips < crackers < fruit < veggies < presliced meat < spreads / oils < bread. If it seems like your running total for the trip won’t cover all that’s on your list then you could forgo some of the less important or more expensive items. When calculating the running total keep in mind that there’s usually a ~10% tax on that will be added to the total. So $70 worth of groceries would end being ~$77 after checkout.

As far as apps, I’ve tried some of them and I found they were too tedious for my taste. Even receipts often obscure what the actually product is your getting with a product shorthand that is illegible. That’s why I have ended up breaking out a smallish notepad for tracking purchases instead of using receipts.

I guess this comment got a little long winded for lemmy, but oh well.

I use the price tags in the store. They show how much each thing costs. If it’s too expensive I don’t buy it. Make potatoes and chicken your reference point. If it’s more expensive think about a substitute. Next trick is that I think what I’m going to cook before I go to store, check what I’m missing and put it on a list. Then I buy things on that list. This helps me not to throw away food.

If you do both things and still spend $10.000 on food you’re only choice is to eat less or eat things you like less which is silly if you can afford it. Tracking each transaction is an interesting hobby but will consume your time and not help you much more than simply being concious about what you buy and not buying things you don’t need.

Sorry I don’t have any app suggestions, but for comparison that seems at least as much or even higher than what my wife and I spend together on our groceries. It might be worth looking at the types of things you’re buying, like there’s a lot of generics that are made in the same place as the name-brand products and sell for half the price. Also do you end up throwing out a lot of food? Your age matters a lot too, because if you’re in your teens or early 20’s you probably have a voracious appetite which goes away as you get older.

I keep a running Google sheet on my phone, and add prices as I buy stuff at the grocery store. I have a core skeleton template with things that I buy every week, and then I add my planned meals and anything I have written down that I need.

It helps to keep impulse spending down, and track costs per meal. Grocery costs have really increased in my area, though. It feels like they’ve doubled in the last two years.

There’s a financial app called Cashew.

Open-source, reasonably priced, works great. Switched after Mint shut down but it’s a big upgrade

Cashew

There are at least two different apps. Which one? This one?OK found it.

https://github.com/jameskokoska/Cashew It does have iOS and Android apps available.

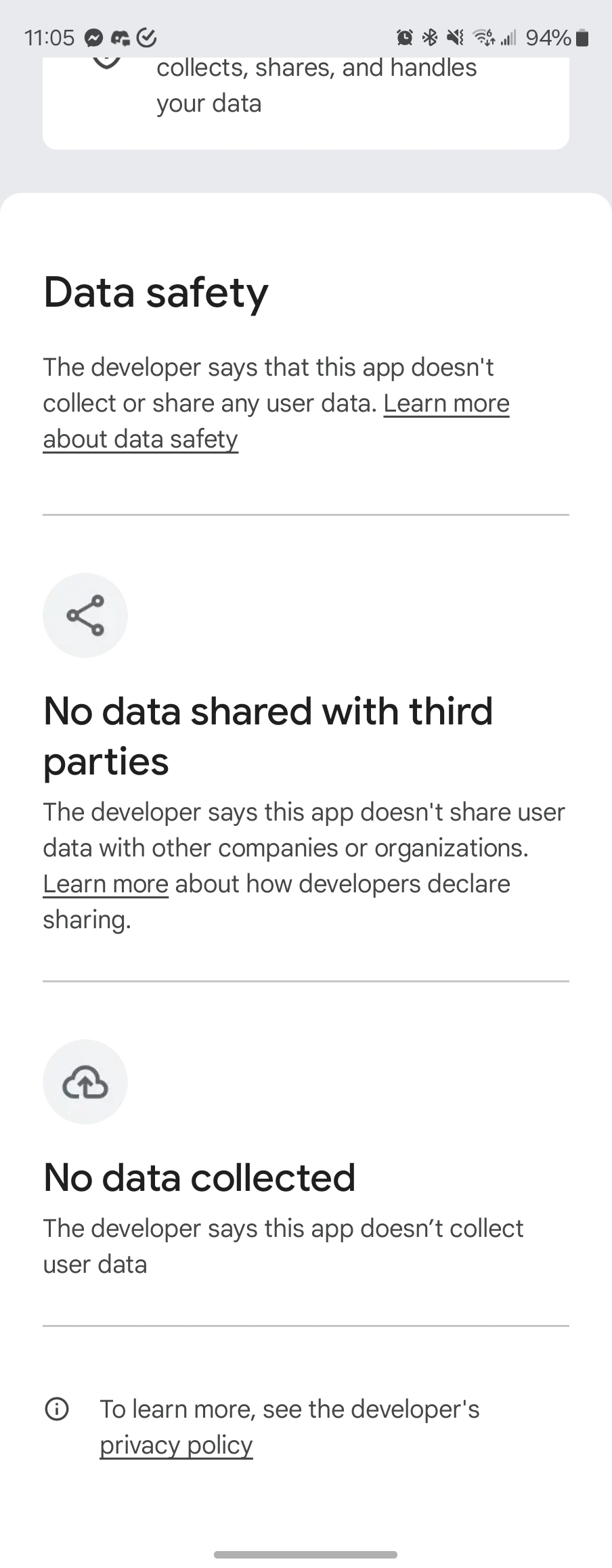

They REALLY need to rename. That first link stole their name and they collect and sell your data.

Can they automatically pull data from your bank accounts?

Is it the one on the Google Play Store by Dapper App Developer? I couldn’t find anything on F-Droid :(

Always nice to see

Always nice to seeYep Dapper

Does it pull data in like Mint did, or do you have to put it in manually? That’s the most important thing to me.

I track all my expenditures with You Need A Budget. If you’re in college, you can get a year free.

Dave Ramsey has his version, EveryDollar. I’ve never used it, but…it’s the same concept.

If you’re just wanting to track grocery expenditures and have that detail of checking historical prices, you might try an AI like ChatGPT to turn a pic of your paper receipt into a spreadsheet, then copy and paste it into Google Sheets.

I’d recommend an alternative to ynab such as Actual Budget or one of the others mentioned in this thread. YNAB is great software but the subscription price of it is getting ridiculous.

My how our education system has utterly failed the last two or three generations. Personal finances used to be taught in High School economics, including how to track spending. With the tap, swipe and scan payments we have these days, few people even keep a record of their spending other than perhaps the account balance. I use a checkbook program and spreadsheet together to keep track of where my money goes, and reconcile it with my bank statement every month to be sure everything adds up. This does mean I have to get paper receipts when I can’t get a digital one, but living your life means you can’t just float around through life expecting the apps and electronics to keep you on track, you have to do some work.