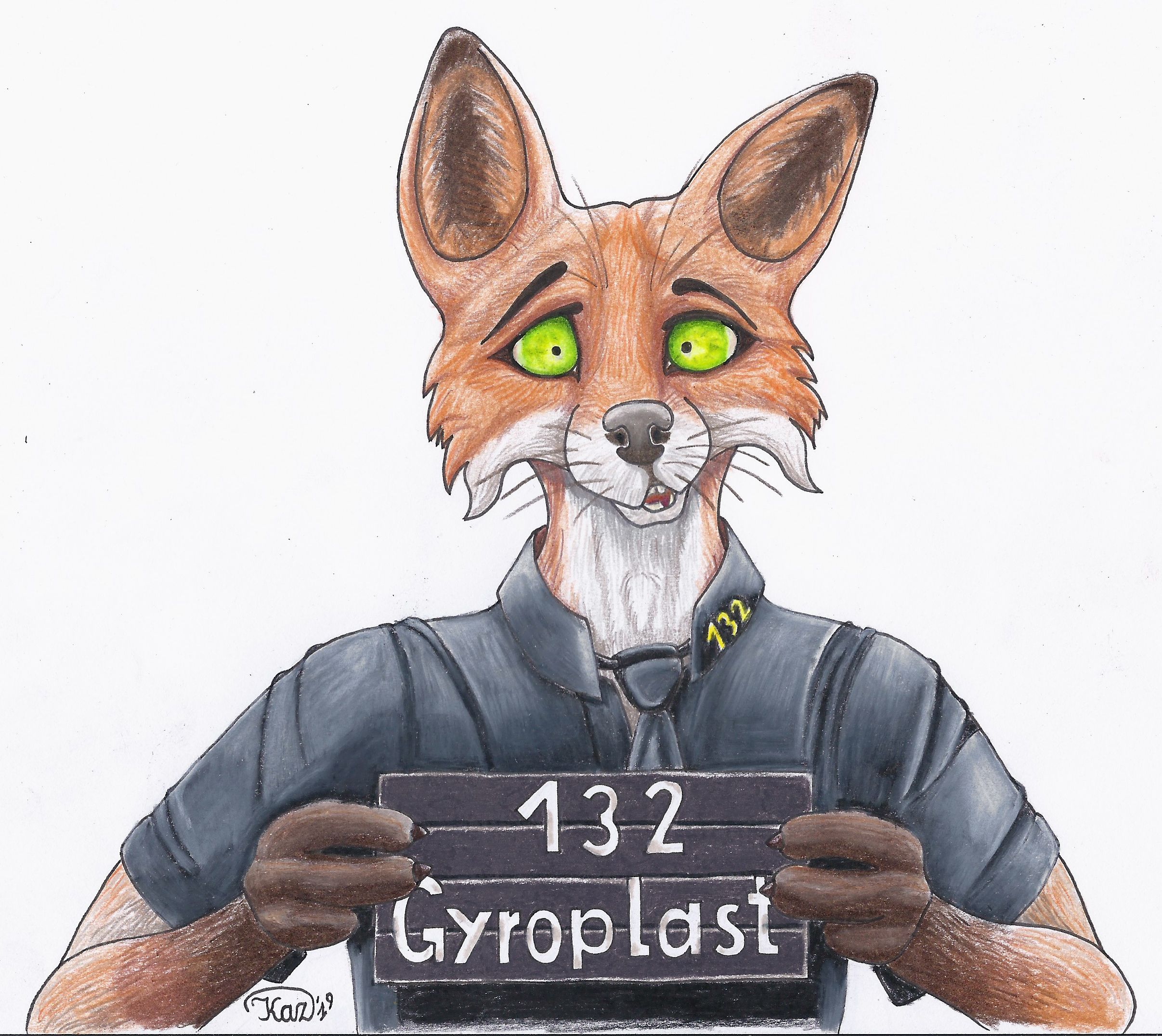

“Cash or credit?” “Arch, btw.”

Sir, this is a wendy’s.

TIHI Why isn’t the logo centered…?

Does this get you a discount on Arch Premium?

It’s how I got my office an amazing deal on Arch Enterprise

I should have done this.

Never leave the home folder without it!

Home dir

Ah, thanks.

This is really lame lol.

Wondering if on the receipt it’ll say you’re running Java.

ASCII art is the best art

neofetch is deprecated. There are several alternatives like fastfetch.

For those who got used to type neofetch they probably just put an alias in for fastfetch

Wait, people type neofetch, as opposed to setting it to run with each time the shell is loaded?

That shit is so annoying especially when I am just using a small window size.

Yeah, and besides I need to see the latest ad for esm support.

“Hey, wanna check out my credit card?”

not a cult

Btw

This is what happens when you think manually partitioning disks and chrooting makes you leet.

Not so glum, chum

No fun allowed!

When I made a new linux install I chose Arch. I think for me the reasoning is thus. While I have a LOT of experience with unborking server linux installs, with desktop it’s just a pain to deal with. I previously used Manjaro which, while very easy to install, does obfuscate a lot of what happens behind the scenes. When it goes wrong, personally I found it harder to fix.

With Arch, beyond enough to give me a terminal and basic gnu tools, I’ve chosen what I install from then on. I think that means when things go wrong there’s a much higher chance I’ll know what it is and how to solve it.

Time will tell if this plan works out or not though :P

I’ve had the same path as you. Arch has been the simplest distro I’ve tried. And with archinstall it’s a breeze.

I’ve also found that Plasma 6 takes away most of the hassle with setting up a desktop - for my use case.

Been using a PC since Win 3.1 and it’s by far the most stable system I’ve ever had

Funny thing is, I did neither of those things the last time I had need to install; the script handled it for me.

show the back

As entertaining as that is, it does raise the question - why do they put all of the details on the back now?

I thought one of the main reasons that the CVV was on the signature strip was so if a card was photocopied, photographed, or carbon copied (literally on carbon paper), then it was still less possible to clone the card.

Is “physical” cloning so small of a problem now that it’s more beneficial to make fancy looking cards? Anyone in the industry able to shine a light?

It’s literally because vain idiots kept posting pictures of their credit card online and getting defrauded.

This is an EMVCo chip card, and not an American one so it’s chip and pin most likely. Without getting too detailed, the chip generates a one time use code for each transaction, so just having the number wouldn’t help with cloning the card plus you also would need to know the PIN. Although skimmers still exist and physical card theft is a thing, it’s less common especially in markets that use chip and pin.

Furthermore even if a card is skimmed these days, at least in the UK, it’s still unlikely transactions would be processed online.

That’s because it’s become so commonplace now for transactions to pop-up in the banks app on the owners phone and they must confirm the transaction and / or receive a code via SMS. Some must SMS as a means to confirm a transaction.

I guess one vector for attack still remains and that in SIM swapping, but even that is more difficult these days due to widespread awareness from carriers.

I mean, if they knew where you usually shop online, probably not. I generally get the popup when either:

1: Shopping somewhere for the first time

2: Certain businesses (presumably those that are more often targeted for fraud I guess?)I bet if they tried to use a different delivery address (and the shop passed that on) it should (I think at least) trigger a security check.

In shops especially with contactless it’s very unlikely to be stopped though. But I think the bank needs to eat the contactless losses if I remember right. I do recall there’s a maximum number of contactless payments you can make in a given time before it forces chip and pin though.

I’m in the US, and all of my cards have the numbers on the back now, and they’re not raised. I’m pretty sure we transitioned to chip and pin like a decade ago.

The transition to contactless (where you tap your card or phone instead of inserting the card) took so long in the USA though. It only really became popular during COVID and with Apple Pay. Home Depot finally enabled contactless payments recently. In Australia, we were using contactless payment 15 years ago!

US banking is behind in a few other ways too. Apps like Venmo and Zelle just don’t exist in some other countries since you can easily do an instant transfer through your bank to anyone else for free. Some US banks still use SMS for two factor auth, which is insecure.

The US uses chip and signature, no joke, because the banks didn’t think people could remember another PIN.

Even though the you already have to use the PIN at an ATM.

No idea why there’s such a big functional difference between “credit” and “debit” cards.

I don’t think there is in terms of process, I think payment handlers just add a higher charge for processing credit card payments, which is why stingy retailers dislike them.

I’m happy to be corrected though.

Absolutely spot on, thank you - always handy to know.

I’m wondering what it does to mitigate the “card not present” fraud though, for online purchases or remote purchases?

In my case, I have to verify online purchases on my bank’s app. Which makes online banking impossible without an android or apple phone.

As far as I understand it the pin&chip system involves a challenge/response between the bank and the card. You can’t just “clone” the chip, because the secret data it contains is essentially write-only.

Sorry, maybe I wasn’t clear.

I’m assuming the 16 digit card number, start and expiry dates, and CVV are printed on the reverse - whereas it used to only have the CVV on the reverse and the rest of the details on the front.

What’s stopping someone with a picture of the rear of the card visiting an online retailer and going wild with a picture of just one side of the card these days - aside from multi-factor authentication at the point of authorising the payment?

Oh! In that case: absolutely nothing. Credit cards are terrifyingly insecure. Whether or not the info is on two sides or one. Any webshop you use your credit card at can just arbitrarily charge it from then on if they feel like it.

Most card allow you to set that transactions have to be approved either by app or by SMS.

The CVV should really be 2FA from your card issuer.

It depends. I got a new MasterCard debit card last week, and the numbers are on the front. Only the CVV is on the back.

Awesome. I miss the raised numerals on the front of the card.

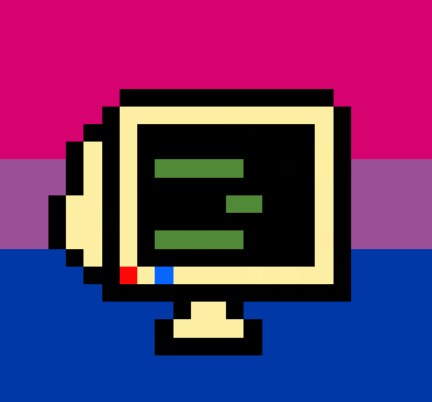

I wonder what distro they use

Color suggests mint

Papara Linux

neofetch maybe?