According to the alternative data platform Quiver Quantitative, replicating Nancy Pelosi’s stock trades would have yielded returns exceeding 720% since May 2014.

Fuck you tiktaktoe Pelosi

Yes, continue focusing on her and never talk about the Republicans that beat her every year.

Would you care to list them so the conversation can be more complete?

Copying a comment from a couple of weeks ago, the source is the website that made everyone really start paying attention to her by posting an infographic that made it easy to visualize the gains compared to the S&P500 but somehow it’s only Pelosi that people complain about

2021 she’s 6th behind 5 Republicans, 2022 she’s under the S&P500 in 27th place, 2023 she’s in 9th place

https://unusualwhales.com/politics/article/congress-trading-report-2022

https://unusualwhales.com/politics/article/congress-trading-report-2023

Thank you.

Brian Higgins had an unbelievably good 2023.

Casual 238.9% ROI, nothing to see here

just looking at the website, you can tell the target audience is specifically the 1% who want republicans to win. it’ll be the same shit with pretty much anything with “business” or “financial” or “economy” in the name of the site

so yea, they will NEVER talk about the insider trading, cheating, fraud, etc. done by republicans

But even in social media, people have been so focused on her whole ignoring that she’s never #1 (heck, in 2022 she got beat by the S&P500) that I can’t help but wonder if there’s some underlying misogyny that explains it…

underlying misogyny

it’s not underlying, it’s blatant, and misogyny is a core part of the GOP platform. yes, republican women are most definitely misogynists

Pretty naive if you think only Republicans are complaining about her trades!

everyone’s absolute top priority for the next three and a half months should be keeping trump out of the white house. complaining about dems doesn’t help to achieve that objective, it hinders it. when trump loses, by all means–criticize all the dems all the time. but at this point, bOtHsIdEs-ing anything is accomplishing nothing but strengthening an R win and weakening D

Please note that my original comment was me pointing out that people complain about a democrat while ignoring all the Republicans that do better than her, so please don’t tell me I’m complaining about the elected Democrats, my only criticism of Democrats was against electors hating on Pelosi instead of their true enemy.

Whataboutism shouldn’t be used by either side. She shouldn’t be doing it.

Why is buying LEAPS of the biggest tech growth stocks in the S&P 500 wrong? That’s literally Paul’s strategy. It isn’t much of a secret.

He’s even lost money plenty of times on individual trades. He sold out of a 25,000 share Nvidia position. That at the time would have been worth around $600k. Had they held that position it would be worth $31M or so now. That’s a huge miss for someone supposedly getting insider info.

She is not a “Mama Bear.”

She is a stock trader who is bought by the owner-class while happily doing their bidding, like most of our politicians. There are reasons why they are allowed to be career politicians.

While AOC tries and fails to be her protégé, who knows she still has a lot of time, and looking at her record, she is well on her way to becoming the new Pelosi.

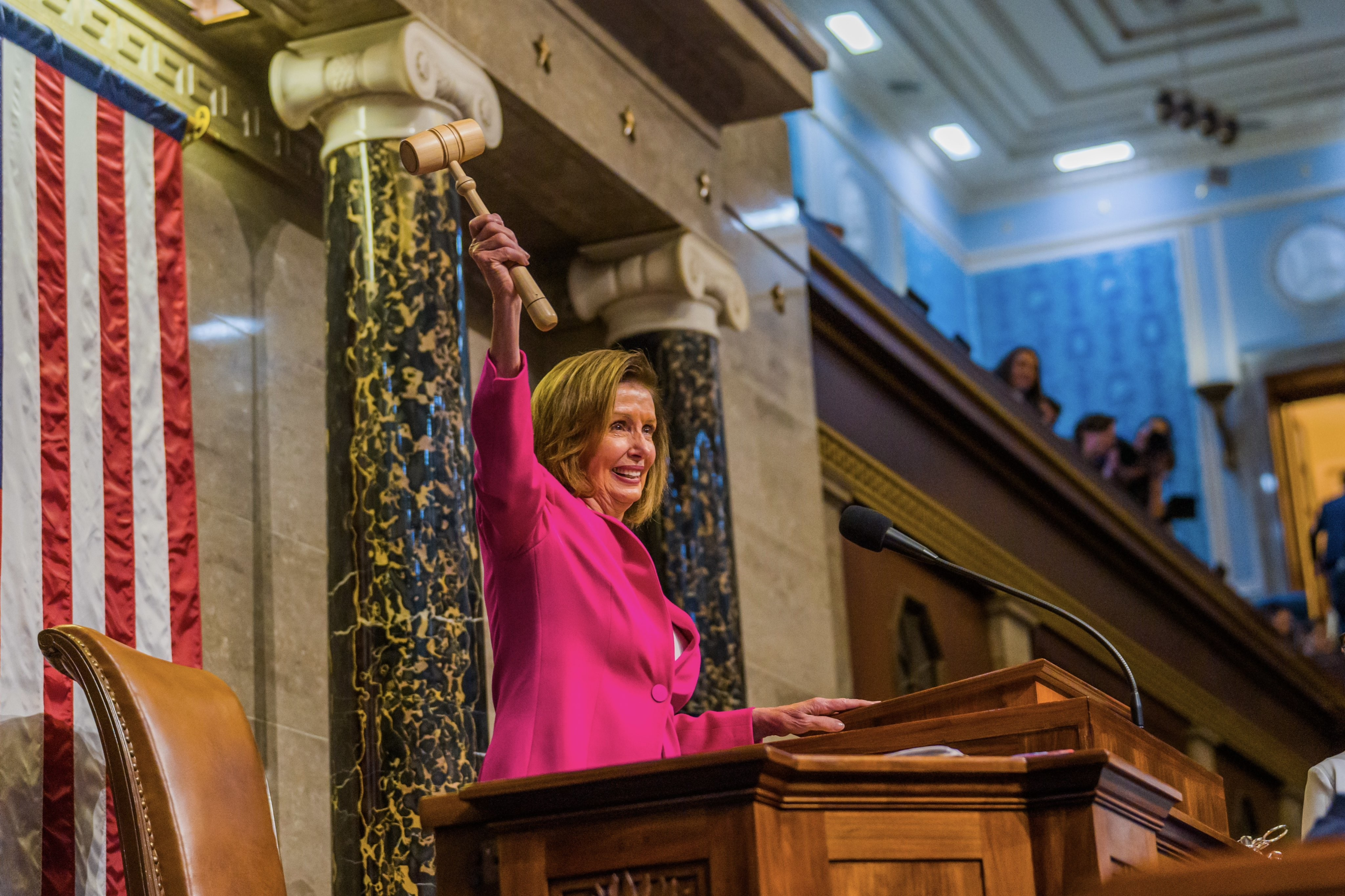

According to the alternative data platform Quiver Quantitative, replicating Nancy Pelosi’s stock trades would have yielded returns exceeding 720% since May 2014. Despite these impressive returns, the former House Speaker continues to face criticism for alleged insider trading and the potential introduction of new trade ban rules for Congress members.

Many have speculated that the California representative and other members of Congress benefit from insider information about laws likely to impact stock prices. For instance, the 2022 CHIPS Act, which offered subsidies for the semiconductor industry, has been a point of contention. Pelosi and her husband, Paul, sold 25,000 Nvidia shares at a loss when Congress approved the Act but later purchased Nvidia call options in significant quantities, as reported by Unusual Whales.

In November 2023, Pelosi acquired 50 Nvidia call options with a strike price of $120 and an expiration date of December 2024, well before Nvidia’s 10-for-1 stock split. “That was definitely one that caught a lot of people’s attention,” noted Quiver Quantitative CEO James Kardatzke in an interview with Business Insider.

For Nvidia investors, it might be reassuring to know that Nancy Pelosi is not the only member of Congress buying Nvidia shares. Representatives Morgan McGarvey of Kentucky and Stephen Lynch of Massachusetts have also added shares of the AI chipmaker to their portfolios.

Pelosi’s trades attract significant attention, but she is one of many Congress members with a portfolio generating substantial returns. Republican Representative Dan Meuser of Pennsylvania has Nvidia as one of his top portfolio holdings, returning 512.8% since August 2019 and over 103% in one year. Similarly, Democratic Senator Sheldon Whitehouse of Rhode Island has invested significantly in the “magnificent seven” stocks: Nvidia, Apple, Amazon, Microsoft, and Alphabet. His portfolio has returned over 492% since February 2014 and over 50% in one year.

Many popular online trackers monitor the trades of US government officials based on the philosophy of “if you can’t beat them, join them.” …Given that the STOCK Act of 2012 requires Congress members to report trading activities within 45 days of execution, the trade completion date isn’t known until much later.

AOC - Pelosi’s protege? With all respect that is possible, this opinion is disconnected from reality.

I’ll just paste the top headlines of Googling “AOC Pelosi”:

Inside Nancy Pelosi’s War With AOC and the Squad - Apr 15, 2021

‘She got so mad at me’: book on the ‘Squad’ details AOC-Pelosi clashes - Nov 30, 2023

Why AOC is behind Biden — while Nancy Pelosi is not - 5 days ago

Video features deepfakes of Nancy Pelosi, Alexandria … - Apr 28, 2023

The clash between AOC and Nancy Pelosi is now a play - Jun 26, 2024

AOC says her life ‘completely transformed’ for the better after Pelosi stepped down from leadership - Nov 30, 2023

Ocasio-Cortez Said Nancy Pelosi Mocked Her Because Of Her Age, New Book Relates - Nov 30, 2023

she is well on her way to becoming the new Pelosi.

You accuse AOC but your copy paste only mentions Pelosi. You got any references to back up your claims?

While AOC tries and fails to be her protégé, who knows she still has a lot of time, and looking at her record, she is well on her way to becoming the new Pelosi.

AOC doesn’t buy stock and is against trading for people in her position

Conflicts of interest.

she conflict on my interest until i return 700%

She’s known as “nance in advance” in trading circles. Some funds follow her investments.

There’s an ETF called NANC that allows you to invest in line with her portfolio. There’s also one called KRUZ that follows Ted Cruz.

https://www.cnbc.com/select/congressional-stock-trading-could-soon-be-tracked/

Looks like NANC is for all Democrat member trades, and KRUZ is for all Republican member trades. If you’re wondering, NANC has +32% standardized pre-tax returns, while KRUZ has +19.1% standardized pre-tax returns.

That’s more just a reflection of the NASDAQ doing better than the DOW over the same period.

I know people who have worked in corporate acquisitions and there are a ton of controls in place to limit information access and prevent the mere appearance of privelged information being used for personal gain. Likewise in other industries like utilities there are pretty complex regulations to prevent companies from getting even a few cents per kilowatt hour advantage, etc. and all this shit has multimillion dollar fines attached.

Congress could definitely adopt a rule that bans trading stocks for anyone who receives classified or nonpublic industry-specific information as part of security briefings or their committee assignments. Or hell, just limit congresspeople to index funds or generic portfolios managed by external fiduciaries, while in office.

It seems that if both Gaetz/Cruz types and AOC agree on this, they could get it done, but the establishment politicians don’t want to because they view it as a perk of the job.

Hey. Shut yer mouth.

AOC and others sound just set up an environmentally friendly index based on their inside information. Republicans will put rules in place the same day.

Doubt

Yeah, the rules will be regarding the information benefiting outside investors instead of Congress.

I’m surprised everyone focuses on insider trading. To me the much bigger risk is: shouldn’t your decisions affecting the country be unaffected by stocks you own? If you own $10 million of Apple stock for example, how does that affect your vote on an antitrust law? This is a problem even if there’s no inside information.

proof that the american dream is real and yall just need to level up your skills 🤷♀️

/s

I’ve almost recovered from the 2008 crash. That’s what I get for investing all my money into the local Arby’s. Who knew their food would actually kill you?

The average Congresscritter doesn’t need to hoard gold bars in their house. Today influence peddling is only slightly more subtle.

Semi unrelated question (also only semi serious): is there a program or script that can follow a person’s trades and make similar trades? Or is she one that, by the time the public knows, it’s already too late to jump on the bandwagon?

Unusual Whales Subversive Democratic Trading ETF (NANC)

There is a congressional rule that requires individual stock trades of certain amounts to be publicly disclosed within 45 days. However this is apparently not really enforced right now.

Some bipartisan congresspeople have proposed more restrictive rules and bans on stock trading, but those efforts haven’t gained traction yet.

By the time the trade is disclosed it’s been like a month and you may be part of the exit liquidity

Look up Quiver Quantative. They actually track investment portfolios of members of the House and Senate and send out newsletters.

Autopilot. It doesn’t support every brokerage though.

I always wondered this too

etoro is a broker that allows you to “copy trade” popular investors and portfolios, which mimc trades according to how much capital you have invested, though Nancy ain’t gonna be on there

There’s also ETFs such as ARK which are easy to get into, are managed by the likes of Cathie Wood and if they’re doing a good job, only go up

Biggest regret in the last 15 years is not getting into it earlier tbh, if you have even a passing interest in trading, open a mock account (or a real one with some money you don’t mind “losing”) and just have a go - it’s very simple nowadays. Gone are the days where you need to pay $10 to a broker to even make a trade

These sites were collecting hand-transcribed data from congress trading disclosures. Unfortunately, the disclosures were almost always made long after the trades. Perhaps that’s why no volunteers have been transcribing data recently.

4 month old account with only this post. Not suspicious at all /s

I mean… that’s not that new. And most people are just lurkers anyways.

Democrats bad!

Yes. Now study actual Left politics so that you understand why what you said is true.

Democrats aren’t even Left. Look at what this article is about for crying out loud.

Dems are center with the center moving to the right at all times.

I was presumptuous but now I get what you’re saying

I’ve managed 60ish% in 3ish years.

Would be higher but i was invested in Cineworld… that was a sore time

That’s pretty good, and if you can maintain that, you’ll have 400% in 9 years.

700% in a decade is very unlikely, without either insider trading or tremendous luck.

I’m personally at 39% also for about 3 years, and AFAIK that’s slightly better than average.It’s was her husband’s job wasn’t it? Not saying what they did was legitimate, but full time job vs side investment should make a difference.