Wow, this is just entirely wrong. Completely and utterly wrong.

Sweden has a maximum of around 55% income tax bracket if you’re in a municipality with high income tax, but billionaires never are and as such would be taxed probably at most 50% income tax bracket.

This is of course entirely irrelevant because billionaires don’t make their money on income. Sweden has fairly low capital gains taxes - 30% on regular accounts, and a special account that taxes the whole account value by a low percentage, which shakes out in average years to even lower taxes on capital. This assumes you even keep your capital in the country, which is a big if.

There’s also no inheritance tax, no gift tax and no property tax. Sweden is actually an unusually good place to be a billionaire as far as taxation goes, and a below average place to earn a high salary as far as taxation goes.

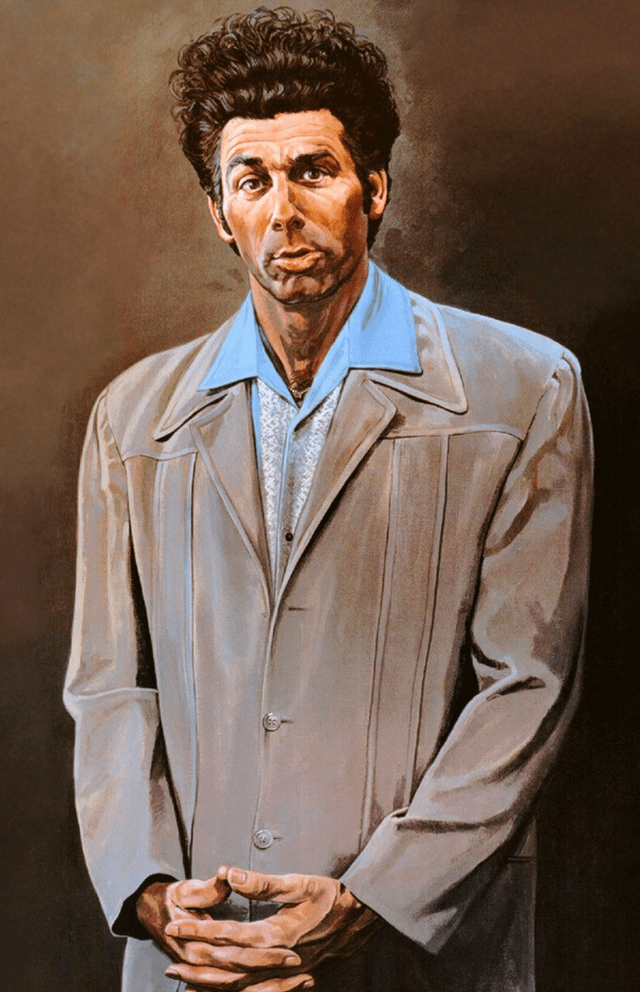

What’s the image in the bottom left from?

All the frames are from the movie “We’re the Millers”

Oh. Haha I’ve seen this image a lot but for some reason all the other panels looked familiar to me as part of some movie I’d seen but forgotten about and this one seemed like the odd one out. Turns out they’re all from a movie I’ve ever heard of.

This scene is worth watching

The rest of it… I’m not so sure

I watched the whole thing. No regerts

We’ve been giving ours billions more dollars that we took from the plebs so they’ll be nice to us

No they’ve never been nice to us, why do you ask?

This is misleading. The 49.5% tax in the Netherlands is on income above €75,518. Billionaires rarely make the bulk of their money as income.

We don’t have a capital gains tax, instead there is a tax on capital that’s based on expected return on that capital. It’s about 1% on money in bank account and about 6% on stock and other investments.

Does that bring in a significant amount of revenue?

If you’re taxing unrealized gains, then that would be a very significant revenue source.

Taxing expected return sounds a bit absurd. What if the capital turns out to be lost, does the state give the tax back?

Omg, like a tax refund? Gimme a break. Fuck the rich with a tire iron.

Dude, I have much of my savings for retirement invested in stocks (ETF’s, it’s a fairly safe investment) since the social security in my country kinda sucks. My return on investment is 5% a year. Having a 6% tax actually means I lose money

The idea is that if such a tax existed the social security wouldn’t suck

That’s a very delusional idea.

Greed should be punished, pro-social vocations rewarded.

Greed is a an antisocial force more effective in its destruction than even hatred.

In practice it means that the rich pay very little tax. It’s been an ongoing debate for years, and changes are being worked on to tax actual gains.

Also misleading, the US gives trillions of tax dollars to the wealthy who are paying nothing. Usually it is in corporate welfare, but a couple years ago they were paid directly.

Same for Germany. It’s income taxes (everything above ~66k/year is 42% taxes and everything above ~277k/year is 45%) no capital gains taxes (they are 25% no matter the amount of capital gains) or asset taxes. Don’t know where the 47% are coming from.

Didn’t know Jennifer Aniston was from the Netherlands…

And somehow there are still lots of loopholes.

Exactly. Thanks to those loopholes, The Netherlands is a tax haven, one of the worst on Earth even. Mind you, the government has decreed that it is not so it must be all good eh?

What a country. In Sweden they tax the billionaires. In America, billionaires tax you!

This means Swedish billionaires work harder than any other billionaires in the world to maintain their status as a billionaire. American billionaires are lazy.

blegh who needs free healthcare, education, worker’s rights, and social services. i enjoy living check to check like 60% of Americans

Start the head tax

As others have pointed out, this is pretty disingenuous. Some (all?) of the others are quoting marginal tax rates — and the US stacks up nicely on this front, at least in progressive states: max federal marginal tax rate is 37%, with California having a 14.4% max marginal rate. So apples to apples, the US would be 51.4%.

The problem, obviously, is that nowhere in the world do billionaires make their money through “normal” income.

If you’re not a billionaire and against this, you’re pretty much a moron and if you’re thinking one day you’ll be a billionaire, you won’t be based on your thought process alone.

There’s no sensible reason why anyone should have no resistance accumulating that much wealth to themselves. It isn’t infinite money for everyone, essentially you’re taking it from others. Yes, some fools kind of deserve or are themselves at blame for parting from their own money, but if there are no stops, it doesn’t motivate others from making sure they create methods to keep doing this to others. All to gain, nothing to lose.