- cross-posted to:

- technology@lemmy.ml

- cross-posted to:

- technology@lemmy.ml

- Spain has moved to block Sam Altman’s cryptocurrency project Worldcoin, the latest blow to a venture that has raised controversy in multiple countries by collecting customers’ personal data using an eyeball-scanning “orb.”

- Worldcoin has registered 4 million users, according to a person with knowledge of the matter. Investors poured roughly $250 million into the company, including venture capital groups Andreessen Horowitz and Khosla Ventures, internet entrepreneur Reid Hoffman and, prior to the collapse of his FTX empire, Sam Bankman-Fried.

- “I want to send a message to young people. I understand that it can be very tempting to get €70 or €80 that sorts you out for the weekend,” España Martí said, but “giving away personal data in exchange for these derisory amounts of money is a short, medium and long-term risk.”

- Sharing such biometric data, she said, opened people up to a variety of risks ranging from identity fraud to breaches of health privacy and discrimination.

I thought the orbs were supposedly open source and not actually transmitting/collecting any biometric data, just using it to create unique ids? But these quotes and articles seem to be taking it as a given that the scans are in fact collected. It feels like a really crucial part of this story is completely missing here; if there’s some evidence that they are in fact collecting the data despite claiming not to, that should be worth mentioning. It would also be something to mention if there is no such evidence and the Spanish regulators here are implying risks that aren’t actually there, but expect it to be a popular move regardless because the public generally hates cryptocurrency, AI, and Sam Altman.

I’m also wondering how they feel about all the various phones and other devices that use fingerprint and face scans for authentication, public facing cameras transmitting to the cloud that can have face or gait recognition algorithms attached, the scanning done in airports, etc. There’s a bunch of reasons to dislike WorldCoin but this seems maybe not well thought out.

I thought the orbs were supposedly open source

No they are proprietary as a whole. Parts of the hardware design are published, and parts of the software that runs on them, but not the whole thing.

Fundamentally Worldcoin is about ‘one person, one vote’, and anyone can create millions of fake iris images; the point of the orb is that it is ‘blessed’ hardware using trusted computing (or to use the term coined by the FSF, treacherous computing) and tamper detection to make sure that a central authority (namely Sam Altman’s Worldcoin foundation) has signed off on the orb running the exact secret / proprietary software running on the orb that generates an identity.

They could have alternatively have built a system that leverages government identity using zero-knowledge proof of possession of a government-signed digital identity document. But I think their fundamental thesis is that they are trustworthy to be a central authority who could create millions of fake identities if they wanted, but that governments are not.

This is the best summary I could come up with:

Spain has moved to block Sam Altman’s cryptocurrency project Worldcoin, the latest blow to a venture that has raised controversy in multiple countries by collecting customers’ personal data using an eyeball-scanning “orb.”

Mar España Martí, AEPD director, said Spain was the first European country to move against Worldcoin and that it was impelled by special concern that the company was collecting information about minors.

The Spanish regulator’s decision is the latest blow to the aspirations of the OpenAI boss and his Worldcoin co-founders Max Novendstern and Alex Blania following a series of setbacks elsewhere in the world.

At the point of its rollout last summer, the San Francisco and Berlin headquartered start-up avoided launching its crypto tokens in the US on account of the country’s harsh crackdown on the digital assets sector.

While some jurisdictions have raised concerns about the viability of a Worldcoin cryptocurrency token, Spain’s latest crackdown targets the start-up’s primary efforts to establish a method to prove customers’ “personhood”—work that Altman characterizes as essential in a world where sophisticated AI is harder to distinguish from humans.

The project attracted media attention and prompted a handful of consumer complaints in Spain as queues began to grow at the stands in shopping centers where Worldcoin is offering cryptocurrency in exchange for eyeball scans.

The original article contains 666 words, the summary contains 214 words. Saved 68%. I’m a bot and I’m open source!

The original article contains 666 words

(◎ 。 ◎)

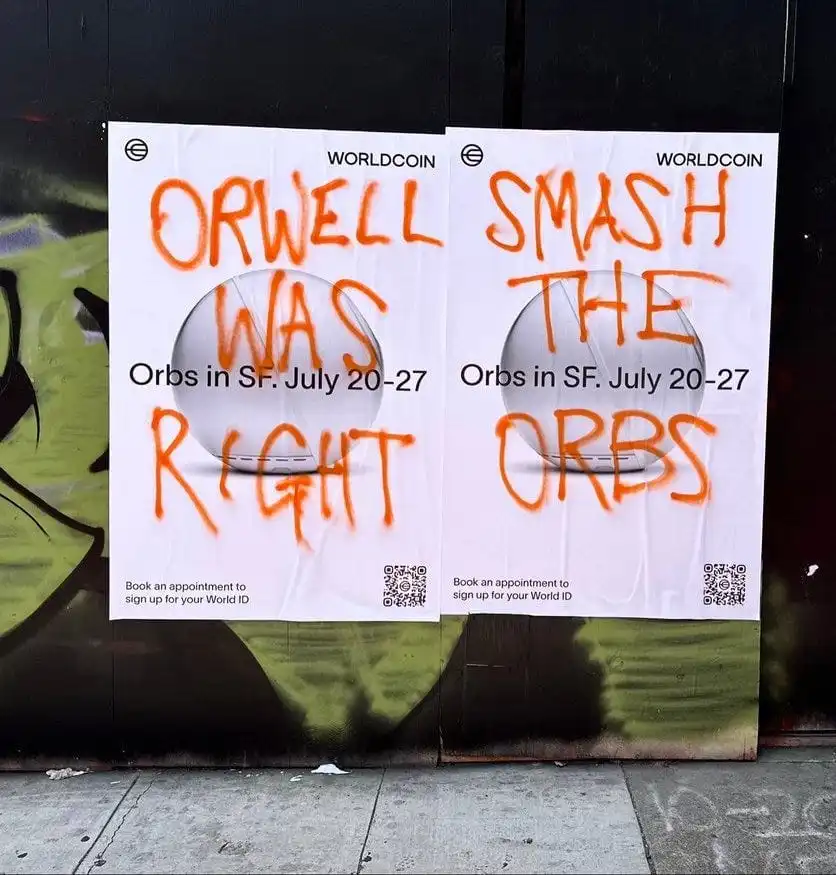

Alt text: Picture of an official Worldcoin poster that reads “Orbs in SF. July 20 - 27” overlaid with orange graffiti that reads “Orwell was right, smash the orbs”

Will this not kill the whole venture? Isn’t the eyeball scanning one of the fundamentals of their “business model”?

The EU certainly has the means and will to fine this into the ground if they don’t comply.

Shutting down eyeball scanning for cash worldwide would basically turn Worldcoin into yet another cryptocurrency so… Yeah.

Edit: looks like somebody thought it was worth real money at some point though. https://coinmarketcap.com/currencies/worldcoin-org/

Anybody remember how cryptocurrency was supposed to democratize money or something? Or am I getting the slogan confused with AI

Anybody remember how cryptocurrency was supposed to democratize money or something?

Smokescreen to get people who don’t really understand computers to buy into a system which can be easily controlled by those who produce/own the physical devices involved, while hiding their tracks near perfectly.

deleted by creator

If I remember correctly, wasn’t Bitcoin originally created for trading Magic: The Gathering cards online?

You’re thinking of Mtgox, a Magic card trading website that reinvented itself as a Bitcoin exchange—and then disappeared with its users’ money.

It did. With Bitcoin, anybody with a cell phone and halfway reliable internet access can send money globally in under a second for pennies in fees (with Bitcoin lightning). They can be their own bank without trusting any single third party. It doesn’t matter if their country has secure banking infrastructure and it doesn’t matter what their credit score is. There are countries on this planet where women aren’t allowed to open bank accounts. Bitcoin doesn’t give AF.

It has promoted and maintained the exact same fiscal policy for 15 years without a single hour of downtime or hack: a limited supply and a guarantee of your ability to transfer your coin to somebody else. No bank holidays, nobody devaluing your currency by increasing the supply. No having your savings robbed by an unstable central bank. It gives anybody in the world access to a currency that is already as stable or more stable than most national currencies. And it gives any country in the world an option aside from using USD and, inherently, losing some degree of autonomy in the process. There’s a reason Ecuador and Argentina went in on it so hard.

People underestimate how big Bitcoin really is. It’s market cap is 850 billion USD, that’s the size of Sweden’s GDP and puts it in the top 25 countries by GDP. On average, it has a trend of consistent growth year after year as adoption continues to increase. It is uncensorable, the US could decide to ban Bitcoin tomorrow, a gamma ray from space could blast half of the earth out of existence, and the next block would come regardless and the network would continue to function.

It does all this for around 1% of global electricity usage, mainly from renewables and is powering a new green revolution by being a “buyer of last resort” for power grids. This makes electricity cheaper for all other users of the grid as it’s able to buy power when nobody else wants it, enabling power generation facilities to not lose money during times of low demand. This also makes it easier for grids to add renewable capacity. Bitcoin is a form of energy storage in that sense. Miners don’t buy power during times of peak demand for price reasons, so it doesn’t take power that anybody else would be using.

15 years without a single hour of downtime or hack

True, not a single hack… Just over $70 billion worth of hacks

https://www.web3isgoinggreat.com/

your currency

Due to the instability of cryptocurrency, calling it currency and not something like “speculative assets” is very funny.

It’s a nightmare to use as a currency.

There’s a reason Ecuador and Argentina went in on it so hard.

Argentina’s poverty levels hit 57% of population, a 20-year high in January

Bitcoin is a form of energy storage in that sense.

I want the drugs you’ve got. Increased interest in cryptocurrency equals higher energy usage. Adoption leads to excess straining of energy without helping anybody except for, as you see in Argentina, the rich.